1.7 — Cantillon, Physiocrats, & Turgot

ECON 452 • History of Economic Thought • Fall 2022

Ryan Safner

Associate Professor of Economics

safner@hood.edu

ryansafner/thoughtF22

thoughtF22.classes.ryansafner.com

Richard Cantillon

Richard Cantillon

Richard Cantillon (?)

1680-1734

An interesting life

- Irish emigre in Paris

- A successful banker, investor (got out before bubbles popped)

- Murdered by his servant, his house & papers burned

Unusually sophisticated and pioneering analysis

Seems to have had little to no influence

- Known to some Physiocrats

- Forgotten until Jevons rediscovered him in 1881

Richard Cantillon

Richard Cantillon (?)

1680-1734

Essay on the Nature of Commerce (1775), published 21 years after his death

One of the greatest writings in the history of economics, comparable with Smith

- Systematic, abstract treatise

- Closely acquainted with details (he was a banker, investor)

- Based on statistics, anecdotes, and personal data collected in The Supplement (tragically never found)

- Has no particular axe to grind

Richard Cantillon: On Agriculture and Cities

Richard Cantillon (?)

1680-1734

- Emphasis on agriculture, physiocratic tendencies

“The Land is the Source or Matter from whence all Wealth is produced. The Labour of man is the Form which produces it: and Wealth in itself is nothing but the Maintenance, Conveniences, and Superfluities of Life” (p.3)

“All Classes and Individuals in a State subsist or are enriched at the Expense of the Proprietors of Land” (p.43)

“The Fancies, the Fashions and Modes of Living of the Prince, and especially of the Landowners, determine the use to which Land is put in a State and cause the variations in the Market-prices of all things.” (p.71)

Richard Cantillon: On Economic Relationships

Richard Cantillon (?)

1680-1734

- Understanding of supply and demand determining equilibrium prices, wages:

“Some Handicrafts-men earn more, others less, according to the different Cases and Circumstances...The Number of Labourers, Handicrafts-men and others, who work in a State is naturally proportioned to the Demand for them” (p.21)

- Idea of natural price based on cost of production

“Intrinsic Value of a Thing”—the price around which the market price will tend to oscillate: “the Price or intrinsic value of a thing [in general] is the measure of the quantity of Land and of Labour entering into its production.” (p.20)

Richard Cantillon: On Entrepreneurs

Richard Cantillon (?)

1680-1734

- First ever description of entrepreneurship and its function:

“The circulation and exchange of goods and merchandise as well as their production are carried on in Europe by Undertakers and are at a risk.”

French: entrepreneurs

Society can be divided into contractually-remunerated labor earning fixed wages, and those who are unhired and live by speculating on the future of markets

Richard Cantillon: On Population

Richard Cantillon (?)

1680-1734

“Men multiply like Mice in a barn if they have unlimited Means of Subsistence; and the English in the Colonies will become more numerous in proportion in three generations than they would be in thirty in England, because in the Colonies they find for cultivation new tracts of land from which they drive the Savages,” (p.83)

“It is also a question outside of my subject whether it is better to have a great multitude of Inhabitants, poor and badly provided, than a smaller number, much more at their ease” (p.85)

Richard Cantillon: On Market Process

Richard Cantillon (?)

1680-1734

- A model of the market process

“Several maîtres d’hôtels [at Paris] have been told to buy green Peas when they first come in. One Master has ordered the purchase of 10 quarts for 60 livres, another 10 quarts for 50 livres, a third 10 for 40 livres and a fourth 10 for 30 livres. If these orders are to be carried out there must be 40 quarts of green Peas in the Market. Suppose there are only 20. The Vendors, seeing many Buyers, will keep up their Prices, and the Buyers will come up to the Prices prescribed to them: so that those who offer 60 livres for 10 quarts will be the first served. The Sellers, seeing later that no one will go above 50, will let the other 10 quarts go at that price. Those who had orders not to exceed 40 and 30 livres will go away empty,” (p.119-121)

Richard Cantillon: On Quantity Theory of Money

Richard Cantillon (?)

1680-1734

- Extends Locke on quantity theory of money:

“M. Locke lays it down as a fundamental maxim that the quantity of produce and merchandise in proportion to the quantity of money serves as the regulator of Market price. I have tried to elucidate his idea in the preceding Chapters: he has clearly seen that the abundance of money makes everything dear, but he has not considered how it does so. The great difficulty of this question consists in knowing in what way and in what proportion the increase of money raises prices,” (p.161)

Richard Cantillon: Cantillon Effects

Richard Cantillon (?)

1680-1734

“From all this I conclude that by doubling the quantity of money in a State the prices of products and merchandise are not always doubled. A River which runs and winds about in its bed will not flow with double the speed when the amount of its water is doubled,” (p.177).

- The first (for a very long time) to document how new money can affect relative prices, not just the price level

- Money is non-neutral in the short run. Money isn’t just dropped from a helicopter

- We call this injection or Cantillon effects, after him

- Don’t get progress on this until the 20th century!

Richard Cantillon: Against Central Banking?

Richard Cantillon (?)

1680-1734

“It is then undoubted that a Bank with the complicity of a Minister is able to raise and support the price of public stock and to lower the rate of interest in the State at the pleasure of this Minister when the steps are taken discreetly, and thus pay off the State debt. But these refinements which open the door to making large fortunes are rarely carried out for the sole advantage of the State, and those who take part in them are generally corrupted. The excess banknotes, made and issued on these occasions, do not upset the circulation, because being used for the buy- ing and selling of stock they do not serve for household expenses and are not changed into silver. But if some panic or unforeseen crisis drove the holders to demand silver from the Bank, the bomb would burst and it would be seen that these are dangerous operations,” (p.323).

The Early 18th Century Economic Bubbles

The Early 18th Century Economic Bubbles

South Seas Bubble in England: 1711-1720

Mississippi Bubble in France: 1716-1719

The South Sea Company

- South Sea Company a joint-stock company founded in 1711

The Governor and Company of the merchants of Great Britain, trading to the South Seas and other parts of America, and for the encouragement of the Fishery

- A public-private partnership meant to consolidate Britain's national debt

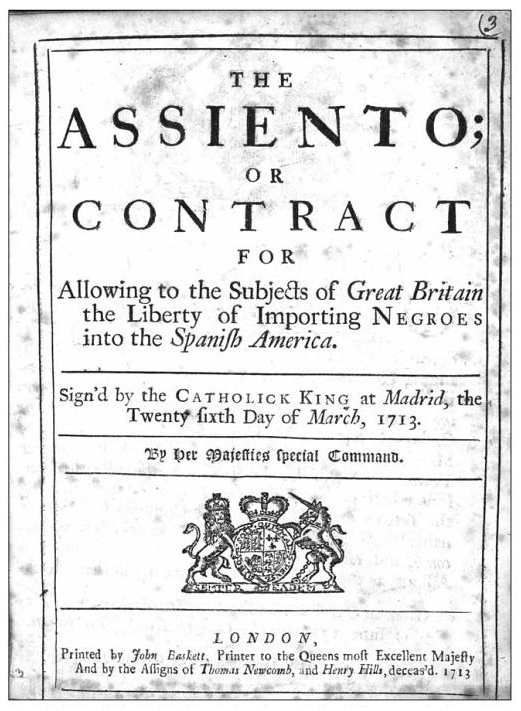

The South Sea Company

To generate income, obtained a monopoly on supplying Spanish American colonies with slaves from Africa

- Agreement with Spain: Asiento de Negros

Britain was currently at war with Spain and Portugal!

- nobody should expect this ever to work

“South seas” = Central & South America (owned by Spain & Portugal!)

The South Sea Company

Bank of England (1694) only recently established as monopoly lender to British government

Reconsolidated government debt into ownership rights in South Sea Company; government would make payments to the company, distributed as dividends to shareholders

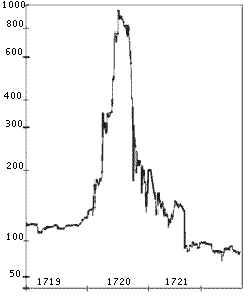

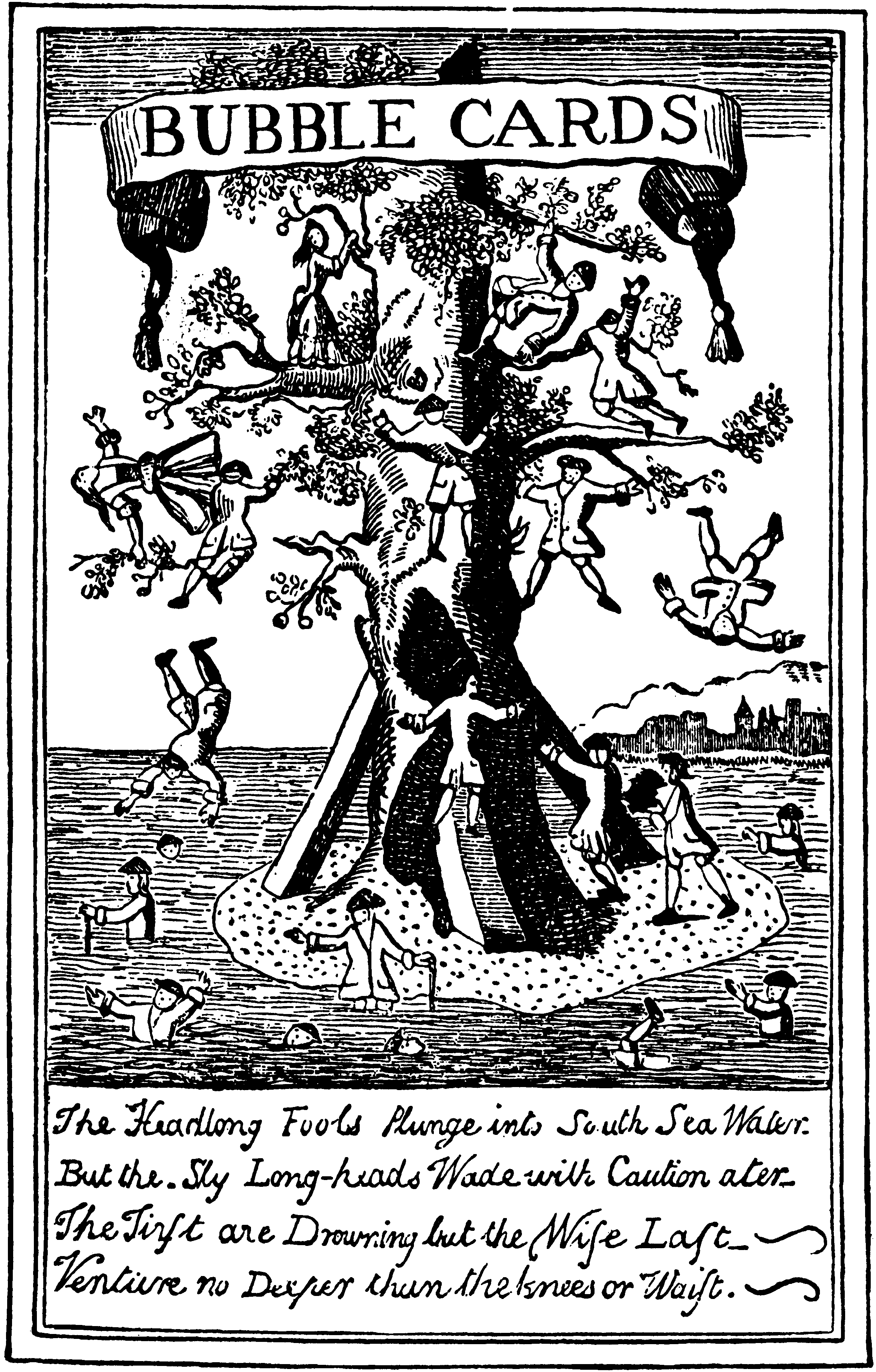

Stock price of the South Sea Company boomed on speculation

Share prices of the South Sea Company

The South Sea Company

Sudden collapse wiped out the wealth of a generation in England

Parliament passed the Bubble Act in 1719, prohibited formation of a joint-stock company without a royal charter

- Later repealed in 1825

France in the Late 17th-Early 18th Century

Louis XIV

Reign of the Sun King Louis XIV

- while militarily the mightiest power in Europe, and flourishing culture and arts...

France lagging behind Britain economically

- still remains very feudal, subsistence agriculture, little manufacturing

Most citizens desperately poor

- constant warfare, high and arbitrary taxation, extreme inequality (nobility are exempt from taxes), strong local lords defy the King, insane rules, regulations, and tariffs that vary town by town, manor by manor

Colbertism

Jean-Baptiste Colbert

1619-1683

Louis’ famous finance minister, Colbert

His system of economic regulation: Colbertism

- sought to improve manufacturing at the expense of agriculture

Heavily interventionist State trying to promote growth

- with lots of frustrations

- origin of “laissez-faire, laissez-passer” as a retort to Colbert

Adam Smith on Colbert

Adam Smith

1723-1790

"[Colbert was] a man of probity, of great industry and knowledge of detail; of great experience and acuteness in the examination of public accounts, and of abilities, in short, every way fitted for introducing method and good order into the collection and expenditure of the public revenue. That Minister had unfortunately embraced all the prejudices of the mercantile system, in its nature and essence a system of restraint and regulation...The industry and commerce of a great country he endeavoured to regulate upon the same model as the departments of a public office; and instead of allowing every man to pursue his own interest his own way, upon the liberal plan of equality, liberty and justice, he bestowed upon certain branches of industry extraordinary privileges, while he laid others under as extraordinary restraints."

John Law

John Law

1671-1729

A Scottish economist who emigrated to Paris

Ideas about money

- money should be issued on the value of land (bound to lead to inflation)

- advocate of paper currency over hard money

John Law and the Mississippi Company

John Law

1671-1729

Louis XIV dies, his son Louis XV is governed by a regent

John Law became Controller General of Finances in France

Creates the Banque Royale, France’s first central bank

- first private, then nationalized

Monetized national debt

- First institution in the world to issue paper currency, backed by French gov't

- fractional reserve banking: issued more paper currency than backed by silver supply

John Law and the Mississippi Company

Law establishes the Compagnie du Mississippi, funded by Bank - a monopoly on trade in North American French colonies (primarily Louisiana)

- eventually buys other companies (East Indies and China companies) and creates a monopoly on all French overseas trade

National debt would be paid off via the Mississippi Company revenue

- John Law became the Duke of Arkansas

- Schemes to get more French into the Americas (only about 700 people there)

- Exaggerated the wealth of Louisiana, driving up share price of Company's stock

John Law and the Mississippi Company

Popularity of shares meant the Bank had to print more currency to meet money demand

Eventually, government had to admit the Bank had printed more currency than exists

Bank customers try to redeem their paper currency in silver - a bank run

France has to devalue its currency, Law fled to Venice

The Physiocrats

The Physiocrats

Our first formal “school of thought” in the history of economics!

Physiocrats: sudden, intense period of economic writings in France in 1750s-1760s

- systematic approach to understanding a nation’s economy

- common themes

- very clear leader: Francois Quesnay

- influential on Smith and Classical Economists

Francois Quesnay

François Quesnay

1694-1774

Originally a famous French doctor, wrote On the Circulation of Blood (note a theme)

Became popular at Versaille among French aristocracy, personal assistant to Madame du Pompadour (King's mistress)

Became a landowner, very interested in agriculture and technical improvements

Wrote articles for Diderot’s famous Encyclopedia on agriculture

Amassed a very dedicated group of followers -- “the physiocrats”

Francois Quesnay and the Physiocrats

François Quesnay

1694-1774

Natural law governing economic affairs: “you simply obey the laws of nature”

Agriculture is the key to the economy and economic growth

- Productive labor: labor for agriculture, an produce a net product (a surplus, “profit?”)

- Sterile labor: manufacturing (and everything else), only able to recover cost of production

Note the idea of “productive vs. sterile labor” will continue with Smith, Marx, etc.

Francois Quesnay and the Physiocrats

François Quesnay

1694-1774

Not just landowner-favoritism and politics!

- Genuinely thought land determined everything

- Land will ultimately bear all the incidence of taxation (all other taxes are irrelevant, should be dropped)

Land increased the net product of society by creating a surplus

Manufacturing in equilibrium only produces value equal to its cost of production

Francois Quesnay and the Physiocrats

François Quesnay

1694-1774

First to focus on the entire economic system as a whole and the flow of wealth through the system

Cared also about the dynamics and growth of the economy over time

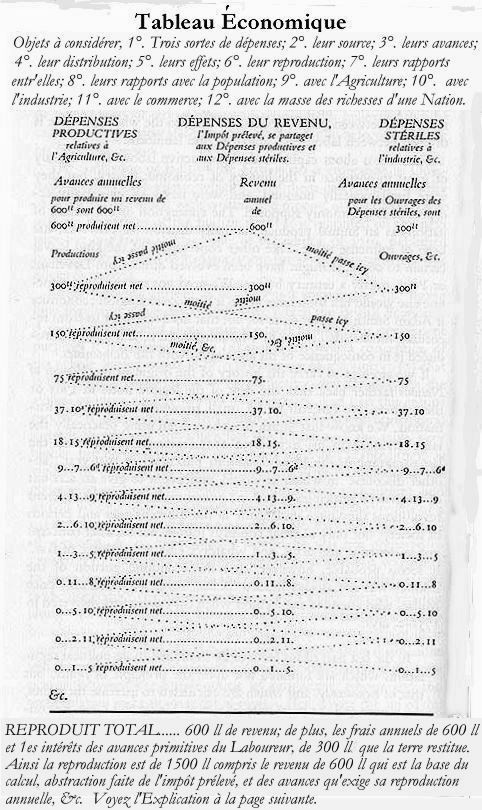

The Tableau économique

Tableau économique, the masterwork of Quesnay and the physiocrats

A macroeconomic model depicting the flow of income through the economy

- divided up by classes: farmers, landowners, and artisans/servants (manufacturing)

- period begins with $2,000 rent income of landowners, then distributed as payments to farm labor & manufacturing labor

Physiocratic Economic Policy

François Quesnay

1694-1774

Attitude towards government: lassiez-faire

- even moreso than Smith and Classical Economists!

Natural order is superior to any human design, economy is self-regulating

Reject Colbertism and mercantilist government policy (interfers with agriculture to promote manufacturing!)

- Trade barriers as primary obstacle to economic growth (can’t export French grain!)

A.R.J. Turgot

Anne-Robert Jacques Turgot

Anne Robert Jacques Turgot

1727-1781

Connected with the physiocrats, but closer to modern ideas than them

Focus on capital and capitalists as lenders, and relationship to entrepreneurs

Louis XVI’s Controller-General of Finances

- removed mercantilist restrictions, end labor conscription, abolish guilds

- forced to resign (plot?); French Revolution would overthrow monarchy in 1789

Reflections on the Formation and Distribution of Wealth (1770)

Anne-Robert Jacques Turgot: On Agriculture

Anne Robert Jacques Turgot

1727-1781

- Physiocratic inspired ideas about importance of agriculture and the net product:

“Primary division of society into two classes: first, the productive class, or the Cultivators; and, second, the stipendiary class, or the Artisans.”

- But the stipendiary class are not necessarily sterile, they can be industrious!

- classes subdivided into “undertakers or capitalists, who make the advances, the other of simple stipendiary workmen” (p.110 in Reader)

Anne-Robert Jacques Turgot: On Rent

Anne Robert Jacques Turgot

1727-1781

"It is evident that if land which produces a revenue equivalent to six sheep, can be sold for a certain value, which may always be expressed by a number of sheep equivalent to that value; this number will bear a fixed proportion with that of six, and will contain it a certain number of times. Thus the price of an estate is nothing else but its revenue multiplied a certain number of times...And so the current price of land is reckoned by the proportion of the value of the revenue; and the number of times, that the price of the sale contains that of the revenue, is called so many years purchase of the land." (p. 106 in Reader)

Anne-Robert Jacques Turgot: On Capital

Anne Robert Jacques Turgot

1727-1781

- First major discussion of capital in economics

“[C]apitals in general, and the revenue of money...There is another way of being wealthy without working and without possessing land...”

- Capital comes from saving a surplus

“As soon as men are found, whose property in land assures them an annual revenue more than sufficient to satisfy all their wants, among them there are some, who, either uneasy respecting the future, or, perhaps, only provident, lay by a portion of what they gather every year, either with a view to guard against possible accidents, or to augment their enjoyments...”(p. 104 in Reader)

Anne-Robert Jacques Turgot: On Capital

Anne Robert Jacques Turgot

1727-1781

"Every species of labour, of cultivation, of industry, or of commerce, require advances. When people cultivate the ground, it is necessary to sow before they can reap; they must also support themselves until after the harvest. The more cultivation is brought to perfection and enlivened, the more considerable these advances are...It is only by means of considerable advances, that we obtain rich harvests, and that lands produce a large revenue. In whatever business they engage, the workman must be provided with tools, must have a sufficient quantity of such materials as the object of his labour requires; and he must subsist until the sale of his goods...The earth was ever the first and the only source of all riches; it is that which by cultivation produces all revenue; it is that which has afforded the first fund for advances, anterior to all cultivation." (p. 105 in Reader)

Anne-Robert Jacques Turgot: On Capital and Labor

Anne Robert Jacques Turgot

1727-1781

- Time structure of production & ownership; opportunity costs of investments; risk-bearing capitalist-entrepreneurs:

“Who shall maintain [the workers]...? It must then be one of those proprietors of capitals, or moveable accumulated property that must employ them, supplying them with advances in part for the construction and purchase of materials, and partly for the daily salaries of the workmen that are preparing them. It is he that must expect the sale of the leather, which is to return him not only his advances, but also an emolument sufficient to indemnify him for what his money would have procured him, had he turned it to the acquisition of lands, and moreover of the salary due to his troubles and care, to his risque, and even to his skill; for surely, upon equal profits, he would have preferred living without solicitude, on the revenue of land, which he could have purchased with the same capital.”(p. 109 in Reader)

Anne-Robert Jacques Turgot: On Capital and Land

Anne Robert Jacques Turgot

1727-1781

“We have seen that every rich man is necessarily a possessor either of a capital in moveable riches, or funds equivalent to a capital. Any estate in land is of equal value with a capital; consequently every proprietor is a capitalist, but not every capitalist a proprietor of a real estate; and the possessor of a moveable capital may chuse to confer it on acquiring funds, or to improve it in enterprizes of the cultivating class, or of the industrious class. The capitalist, turned an undertaker in culture or industry, [is] taken up in the continuation of their enterprizes. The capitalist who keeps to the lending money, lends it either to a proprietor or to an undertaker. If he lends it to a proprietor, he seems to belong to the class of proprietors, and he becomes co-partitioner in the property; the income of the land is destined to the payment of the interest of his trust; the value of the funds is equal to the security of his capital” (p. 117 in Reader)

Anne-Robert Jacques Turgot: On A Lot of Things

Anne Robert Jacques Turgot

1727-1781

Various section titles:

The spirit of oeconomy continually augments the amount of capitals, luxury continually tends to destroy them.

The price of interest depends immediately on the proportion of the demand of the borrowers, with the offer of the lenders, and this proportion depends principally on the quantity of personal property, accumulated by an excess of revenue and of the annual produce to form capitals, whether these capitals exist in money or in any other kind of effects having a value in commerce.

The rate of interest ought to be fixed, as the price of every other merchandize, by the course of trade alone.

The current interest of money is the standard by which the abundance or scarcity of capitals may be judged; it is the scale on which the extent of a nation’s capacity for enterprizes in agriculture, manufactures, and commerce, may be reckoned.